Palantir Just Nailed a Major NATO Win. Should You Buy PLTR Stock Now?

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir Technologies (PLTR) surged 4.6% on Monday, April 14 following news that NATO closed a contract to deploy the Maven Smart System NATO (MSS NATO) technology, which is an artificial intelligence-based battlespace awareness platform created by U.S.-based software provider Palantir. The agreement represents a huge win for Palantir in European defense markets, expanding from its partnership with U.S. military forces to all of NATO.

This comes after an unpredictable couple of months for PLTR stock. After hitting new 52-week highs above $125 in early 2025, shares came under pressure as news emerged that President Donald Trump intended to slash the defense budget over the next several years.

However, the NATO agreement seems to have allayed investor anxiety, with analysts speculating that it will spur more international defense tech deals. In addition, Palantir’s AI platforms are still firmly ingrained in the U.S. Army, Air Force, and Space Force, and in September 2024, the company received a $100 million extension to its U.S. military software contract. This contract extension also was related to its Maven Smart System technology.

About Palantir Stock

Palantir Technologies (PLTR) is an AI and big data analytics software company based in Denver that focuses on working with government and defense clients. The company is one of the preeminent contractors of AI-enhanced national security platforms, serving both domestic and international clients. The company’s market capitalization is over $230 billion, commanding a position at the nexus of technology and defense infrastructure.

PLTR stock is up by 20% year to date, far outperforming the S&P 500 Index ($SPX), which is down over 10% in that timeframe. The stock has traded widely based on shifting investor attitudes about defense spending and AI investment. The stock surged on Monday on the NATO news before backing off as overall market weakness took hold.

Palantir trades at a forward price-earnings ratio of 285x, which is rich even by growth stock norms. The argument is that this rich valuation is warranted by Palantir’s contractual stickiness with governments, growing adoption of AI, and sustained free cash flow. Its price-sales ratio is at approximately 76x, which means the valuation is banking massively on long-run execution.

Palantir Beats on Earnings

Palantir announced a blockbuster Q4 with revenue increasing 36% year-over-year to $828 million, fueled by accelerating commercial and government sector adoption of its platforms. The U.S. market drove growth, with U.S. revenue increasing by 52% year-over-year, with a 64% rise in U.S. commercial sales to $214 million and 45% growth in U.S. government revenue to $343 million.

The company posted adjusted EPS of $0.14, which surpassed consensus expectations of $0.05. On a GAAP basis, EPS came through at $0.03, with non-GAAP EPS of $0.07, excluding one-time stock-based compensation related to SARs. Palantir also recorded GAAP net income of $79 million, or adjusted $165 million, which is its fifth straight quarter of GAAP profitability. Cash from operations reached $460 million, which is a solid 56% margin, with free cash flow touching $517 million, a margin of 63%.

Palantir closed 129 deals worth more than $1 million, with 58 worth more than $5 million and 32 worth more than $10 million, and U.S. commercial total contract value (TCV) increased by 134% year-over-year to $803 million. The customer base increased by 43% to 497, with the remaining U.S. commercial deal value (RDV) almost doubled to $1.79 billion.

In 2024, revenue increased by 29% year-over-year to $2.87 billion, with U.S. commercial revenue increasing by 54% and U.S. government revenue increasing by 30%. Net income came in at $462 million.

For the future, Palantir forecasted 2025 revenue expansion of 31%, much higher than the consensus. The company restated its position “in the center of the AI revolution,” with founder Alex Karp professing that Palantir’s thesis in AI is moving “from theory to fact.”

The next earnings report will be on May 5.

What Do Analysts Expect for Palantir Stock?

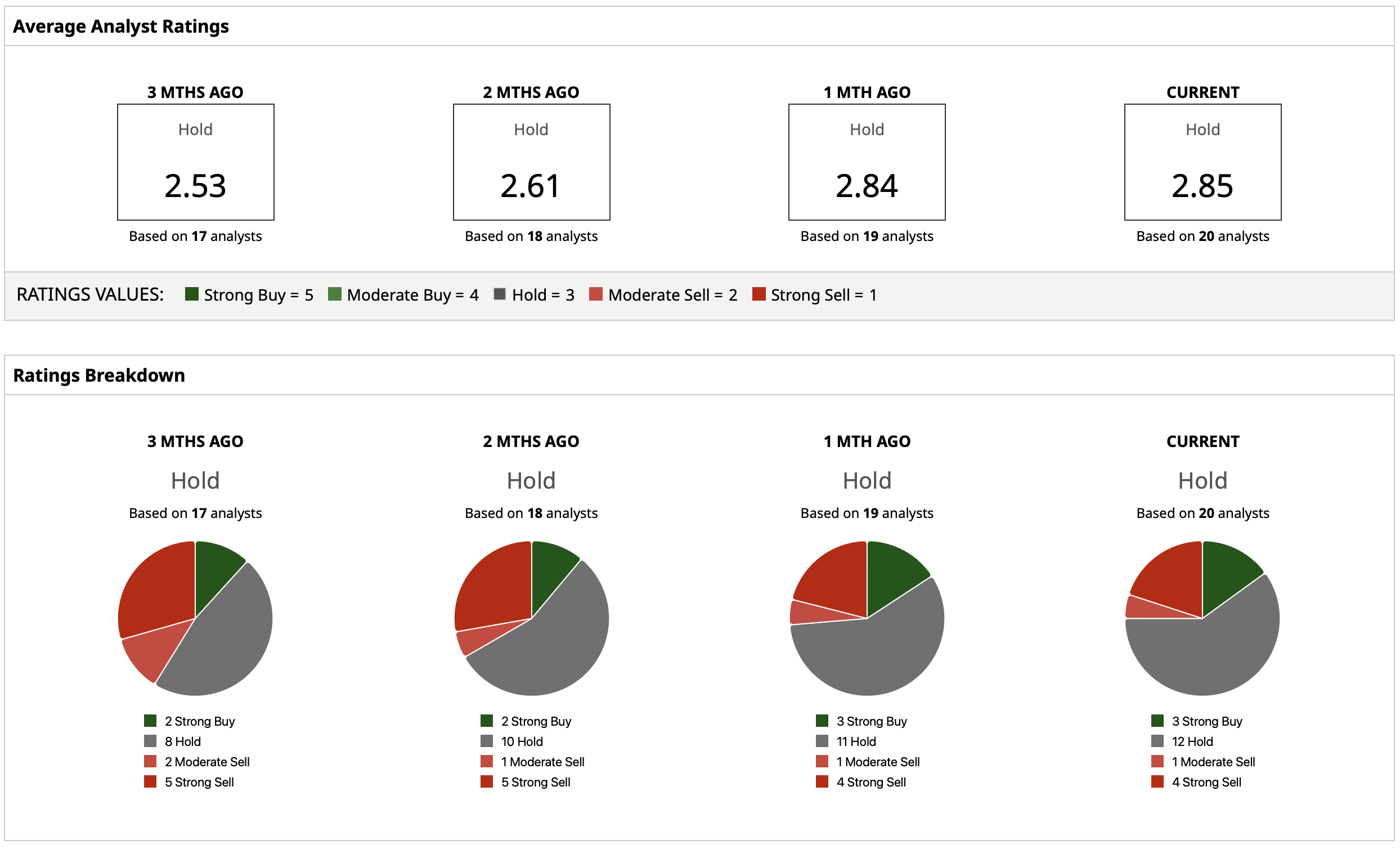

Palantir is being followed by 20 analysts with an overall consensus rating of “Hold.” As of the latest data, 20 analysts cover PLTR, with an average rating of 2.85 on Barchart’s 5-point scale, up from 2.53 three months ago. The breakdown includes three “Strong Buy” ratings, 12 “Hold,” one “Moderate Sell,” and four “Strong Sell” recommendations.

Despite strong momentum in government AI spending, the valuation remains a sticking point. At current levels above $90, the stock trades well above most fair value models. Any upgrades from here may hinge on Palantir expanding further into commercial AI deployments or delivering another earnings surprise on May 5.

On the date of publication, Yiannis Zourmpanos had a position in: PLTR . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.