Alphabet Reports Q2 Earnings July 23. Time to Buy GOOGL Stock?

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

Tech giant Alphabet (GOOGL) will report its Q2 earnings on July 23. Despite a strong rebound in recent months, with GOOGL stock climbing over 27% in the last three months, shares of the tech giant remain in the red so far this year. This lagging year-to-date performance reflects broader market concerns, particularly around heightened legal and regulatory scrutiny, an uncertain economic backdrop that could hurt advertising budgets, and stiff competition in the artificial intelligence (AI) space.

Nonetheless, Alphabet’s long-term prospects remain solid, and its business continues to show solid momentum across its major segments. Search remains a dominant catalyst, while Google Cloud is benefiting from robust enterprise demand, and the company’s subscription services, including YouTube Premium and Google One, are steadily growing their user base.

That said, Alphabet is facing tough year-over-year comparisons in advertising revenues, which could weigh on the pace of growth in the near term. In its cloud business, although demand remains high, capacity constraints may limit the company’s ability to fully capitalize on that interest in the short run.

With this backdrop, let’s take a look at analysts’ expectations for Q2.

Alphabet’s Q2 Outlook: Momentum Driven by AI, Cloud, and YouTube

Alphabet heads into its second-quarter earnings with strong momentum following a stellar Q1, where the tech giant posted double-digit growth across its core segments, including Google Search, YouTube, Cloud, and subscriptions. This broad-based strength is expected to continue into Q2, driven largely by Alphabet’s integration of AI throughout its ecosystem.

The tech giant embedded AI across major platforms, enhancing Search with features like AI Overviews and Circle to Search. Notably, AI Overviews alone attracted over 1.5 billion monthly users, reflecting growing user engagement. YouTube is also leveraging AI to enhance content discovery and ad targeting, while Google Cloud is experiencing strong demand from enterprises for its AI-powered services and data analytics capabilities.

Search remains Alphabet’s primary revenue engine. Despite challenging year-over-year comparisons, ad revenue from Search is poised to grow again in Q2, driven by sustained user engagement and digital advertising trends. YouTube, too, is on solid footing. Ad revenues are expected to rise, supported by both brand and direct-response advertising. YouTube Shorts is a standout performer, with engagement likely to continue growing and monetization showing steady improvement in the U.S.

YouTube’s leadership in video streaming continues to strengthen. With the expansion of ad formats and a growing subscription base, including over 125 million global users for YouTube Music and Premium, the platform is well-positioned for recurring revenue growth. The recent expansion of its Premium Lite offering in the U.S. adds further flexibility for users and deepens monetization opportunities.

Google Cloud remains a significant growth driver, with the segment delivering revenue of $12.3 billion in Q1, representing a 28% year-over-year increase. The surging demand for AI solutions and better cost control will enable the company to deliver solid revenue and operating profit in this segment.

Finally, Alphabet’s subscription and devices segment is emerging as another robust contributor. With over 270 million paid subscribers at the end of Q1, this segment is helping Alphabet build a stable and loyal customer base.

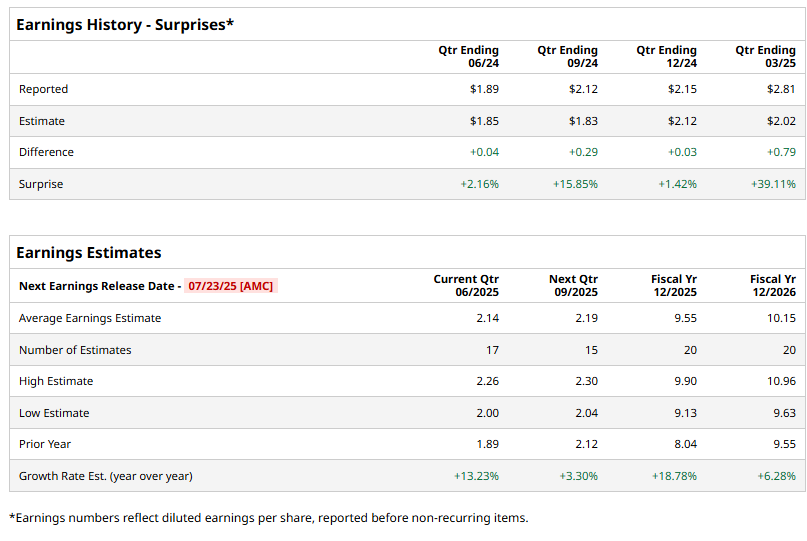

Beyond revenue, Alphabet’s profitability is expected to improve. Wall Street analysts are forecasting earnings of $2.14 per share for the second quarter. That’s a 13.2% jump from the $1.89 per share the company posted during the same period last year.

Alphabet has consistently outperformed expectations. It has beaten analysts’ earnings estimates for four straight quarters. Just last quarter, Alphabet delivered a solid 39.1% earnings beat, far surpassing what analysts had anticipated. This strong track record of earnings surprises suggests Alphabet may once again outshine expectations, which could boost its share price.

Is GOOGL Stock a Buy Now?

As Alphabet gears up to report its Q2 earnings on July 23, challenges such as tough advertising comps and cloud capacity limitations may temper the pace of growth in the near term.

That said, the growing momentum in key areas, such as AI, cloud computing, YouTube, and subscriptions, signals that the company’s growth engine is far from slowing down.

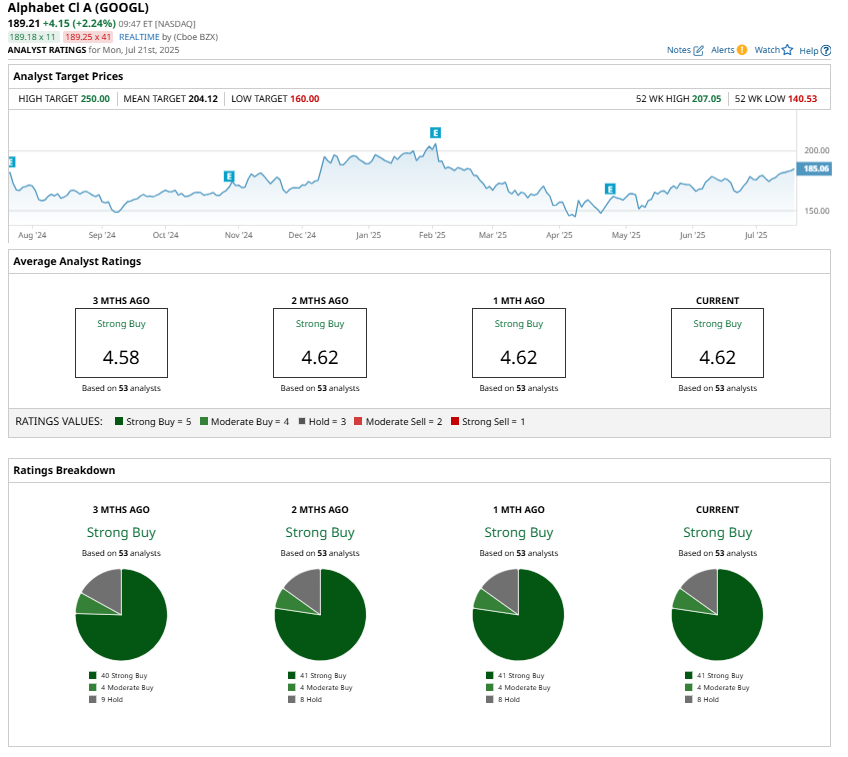

Wall Street analysts are bullish about Alphabet’s prospects ahead of Q2 earnings and maintain a “Strong Buy” consensus rating. Alphabet’s consistent track record of earnings beat suggests it could once again deliver an upside surprise.

Given its strong fundamentals, GOOGL stock is a buy for investors willing to look beyond the short-term noise.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.